GJC Banking Summit 2025: Driving Growth Through Finance

At the Jio World Convention Centre, Mumbai, the All-India Gem and Jewellery Domestic Council (GJC) hosted its Banking Summit 2025 on September 15 under the theme "Driving Growth Through Finance." The event served as a strategic platform to bridge the financial ecosystem with India's dynamic gems and jewellery (G&J) sector, a pillar of the nation's export economy and cultural heritage. Through three insightful sessions, industry leaders, bankers, and policymakers explored how finance could empower jewellers, enhance transparency, and fortify India's global standing in precious trade.

Session 1: Bridging the Gap — Strengthening Synergy Between Banking and Jewellery Sectors

The opening session, "Bridging the Gap," set the tone for the day by addressing one of the most crucial relationships in the industry — that between banks and jewellers. Moderated by Mr. Sumesh Wadhera of AOJ Media, the panel brought together experts including Mr. Manish Goel (ICICI Bank), Mr. Dilip Narayan (Malabar Gold), Mr. Ajit Mauskar (World Gold Council), Mr. Ravi Prakash Agarwal, and Mr. Nitin Khandelwal, both representing GJC.

The discussion delved deep into the trust deficit that often clouds the banking sector's perception of the jewellery industry. Despite being one of India's most significant contributors to GDP and employment, jewellers have long faced stringent lending norms and limited access to credit due to perceived risks. The speakers unpacked these issues, emphasizing the need to shift narratives from suspicion to structured collaboration.

They discussed ways in which banks could redefine lending frameworks for jewellers, particularly for MSMEs that often struggle with collateral requirements. Flexible loan structures, improved digital underwriting, and faster processing through fintech collaborations emerged as key recommendations.

A particularly innovative idea discussed was the potential of EMI-based purchase models for jewellery buyers — a mechanism that could democratize access to fine jewellery and stimulate consumer demand, much like the electronics and automobile sectors. The panellists also touched upon regulatory guardrails and consumer protection, underlining the need for responsible credit-based retailing.

The session concluded with a collective call for building a sustainable, trust-based financial bridge — one that could unlock the full potential of India's jewellery trade.

Session 2: Credit Rating Essentials — Unlocking Financial Opportunities for Jewellers

The second session, "Credit Rating Essentials," explored how credit ratings could serve as a passport to financial empowerment for jewellers. Moderated by Mr. Sahil Mehra, the panel featured thought leaders including Mr. Amit Soni (GJC), Mr. Bhargava N. Vaidya (B.N. Vaidya & Associates), Mr. Prakash Agarwal (Gefion Capital Advisors), Mr. Manu Sehgal (Brickwork Ratings), Mr. Mohit Makhija (CRISIL Ratings), and Prof. Naved Ansari (Finmet India Pvt. Ltd.).

Speakers noted that while credit ratings are standard practice in other industries, their adoption in the jewellery sector remained relatively low — with only 15–20% of registered jewellers availing themselves of ratings as of 2025. Yet, those who had done so reported remarkable benefits: easier access to loans, better negotiation power with financial institutions, and improved transparency in business operations.

The session illuminated the parameters used by credit rating agencies, extending beyond financial ratios to include operational efficiency, inventory management, supply chain resilience, and market presence. The experts underscored that a robust rating could help transform the perception of jewellers from traditional traders to disciplined, data-backed enterprises — a shift essential for attracting institutional finance.

Importantly, the discussion framed credit ratings not merely as a compliance measure but as a strategic business asset — one that could redefine the credibility and scalability of Indian jewellery brands in both domestic and international markets.

Session 3: Trade Dynamics — Navigating Exports Amid Tariff Challenges

The final session, "Trade Dynamics," steered the conversation to global waters. Moderated by Mr. Mrityunjay Kumar Jha of Zee Business, the panel featured Mr. Avinash Gupta (Vice Chairman, GJC), Mr. Saiyam Mehra (Immediate Past Chairman, GJC), Mr. Manish Goel (ICICI Bank), Mr. Chirag Sheth (Metal Focus Ltd.), and Mr. Ashok Gautam (India International Bullion Exchange - IIBX).

The discussion examined how volatile trade policies and shifting tariffs were reshaping India's position in the global jewellery export landscape. As traditional markets mature and competition intensifies, the panellists emphasized the importance of market diversification — especially into regions such as the Middle East, Africa, and Europe.

Speakers advocated for enhanced product standardization, greater focus on value-added jewellery, and leveraging trade agreements to maintain India's competitive edge. The role of regulatory and policy support was also foregrounded, with calls for consistent government engagement to stabilize export incentives and streamline compliance.

Another key insight was the need for jewellers to balance agility with long-term strategy — investing in branding, design innovation, and digital channels while navigating short-term tariff disruptions. The panellists unanimously agreed that India must continue its journey toward becoming a global hub for ethical, sustainable, and technologically advanced jewellery manufacturing.

Conclusion: A Collective Vision for Financial Empowerment

As the summit drew to a close, it became evident that the day's discussions had transcended mere finance — they represented a reimagining of trust and transformation. From credit access to export resilience, the sessions highlighted a collective vision for a more transparent, connected, and globally competitive gems and jewellery industry.

By bringing together bankers, traders, and policymakers under one roof, GJC's Banking Summit 2025 reaffirmed a simple yet powerful belief — that finance is not just capital, but confidence. And when confidence meets collaboration, the gold standard of India's jewellery trade shines even brighter.

Related Stories

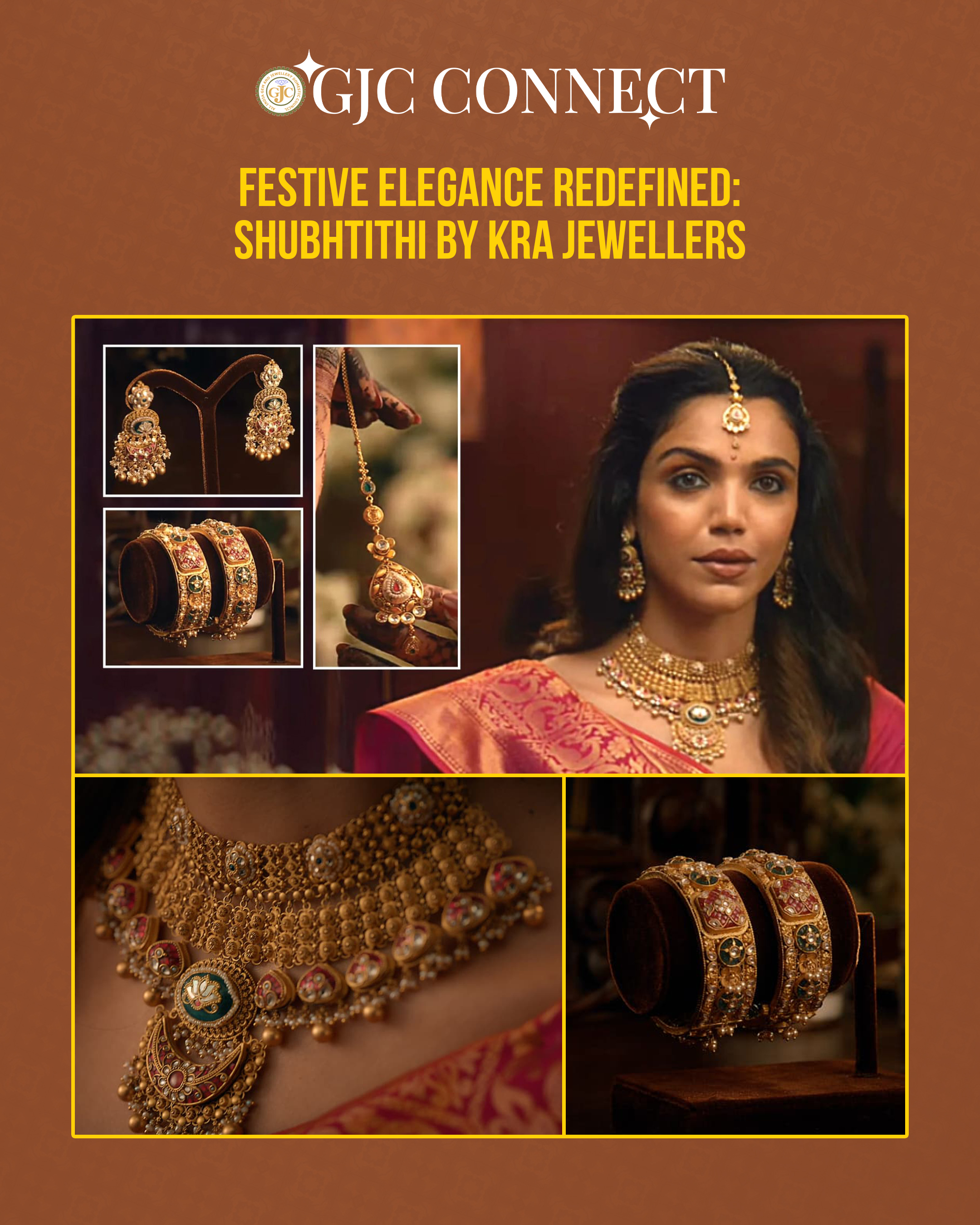

Festive Elegance Redefined – Shubhtithi by KRA Jewellers